The last year has put emphasis on the importance of one’s home. As a result, some renters are making the jump into homeownership while some homeowners are re-evaluating their current house and considering a move…

READ MORE

There’s a lot of discussion about affordability as home prices continue to appreciate rapidly. Even though the most recent index on affordability from the National Association of Realtors (NAR) shows homes are more affordable today than the historical…

READ MORE

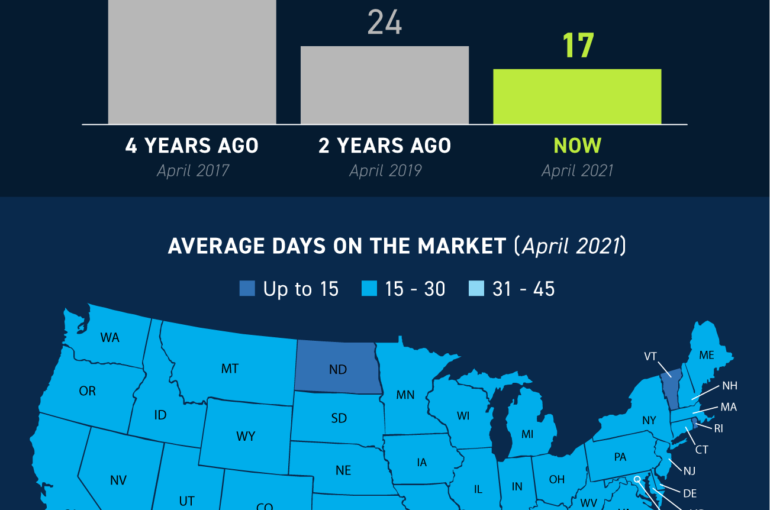

Some Highlights In today’s whirlwind real estate market, houses are selling at astonishing speed – from sea to shining sea. Four years ago, the average house spent 39 days on the market. Two years ago,…

READ MORE

If you’re thinking of buying or selling a house, chances are you’re focusing on the many extraordinary ways it’ll change your life. What you may not realize is that decision impacts people’s lives far beyond your own….

READ MORE

Some Highlights If you’re thinking of selling your house but don’t know what you should buy, you have options. Existing homes offer a wide variety of home styles, an established neighborhood, and lived-in charm. Meanwhile, new home construction lets…

READ MORE

Our homes are so much more than the houses we live in. For many, they’ve also become our workplaces, schools for our children, and safe harbors in which we’ve weathered the toughest moments of a…

READ MORE

This year, Americans are moving for a variety of reasons. The health crisis has truly reshaped our lifestyles and our needs. Spending so much more time in our current homes has driven many people to…

READ MORE

Are you clamoring for extra rooms or a more functional floorplan in your house? Maybe it’s time to make a move. If you’ll be able to work remotely for the long-term or your overall needs…

READ MORE

Some Highlights June is National Homeownership Month, and it’s a great time to consider the benefits of owning your own home. If you’re thinking of buying a home, it might just help you find the…

READ MORE